Loci Products

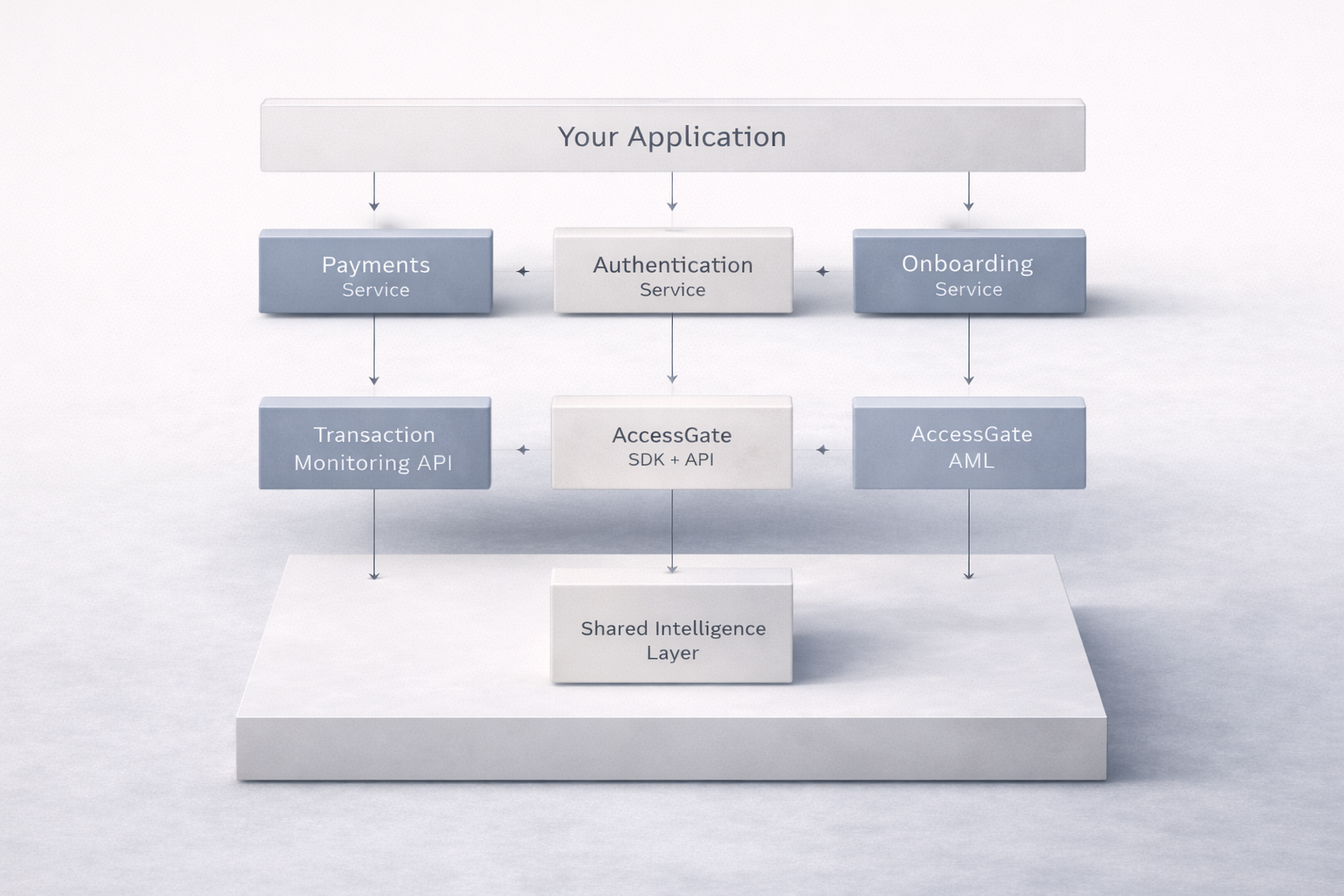

Three integrated products. One unified intelligence layer.

Loci's products work independently or together—sharing intelligence to create a compounding defense that gets smarter with every transaction.

The Three Pillars

Transaction Monitoring

Real-time fraud detection with explainable decisions

The MADIE engine evaluates transactions against composable rules written in FLM (Fraud Language Model). Every decision includes a complete audit trail showing exactly why a transaction was flagged.

→ Transaction Monitoring Deep Dive

Key capabilities:

- Sub-200ms decision latency

- Weighted composite rules (not binary triggers)

- Network graph intelligence

- Dynamic calibration (no manual threshold tuning)

AccessGate

Continuous authentication via behavioral biometrics

Verify users throughout their session—not just at login. AccessGate analyzes how users interact with your application (typing patterns, mouse movements, navigation behavior) to detect account takeover in real-time.

Key capabilities:

- Zero-friction authentication (no user interaction required)

- 7-dimension behavioral analysis

- Self-tuning baselines (no labeled data needed)

- Bot and credential stuffing detection

AccessGate AML

Sanctions screening with relationship intelligence

Screen customers against global sanctions lists with second-degree relationship detection. The Agent API provides rich context for AI-powered compliance workflows.

Key capabilities:

- 6+ global sanctions lists (daily updates)

- Relationship graph (detect associates of sanctioned entities)

- AI agent integration (LLM-optimized responses)

- Sub-100ms screening latency

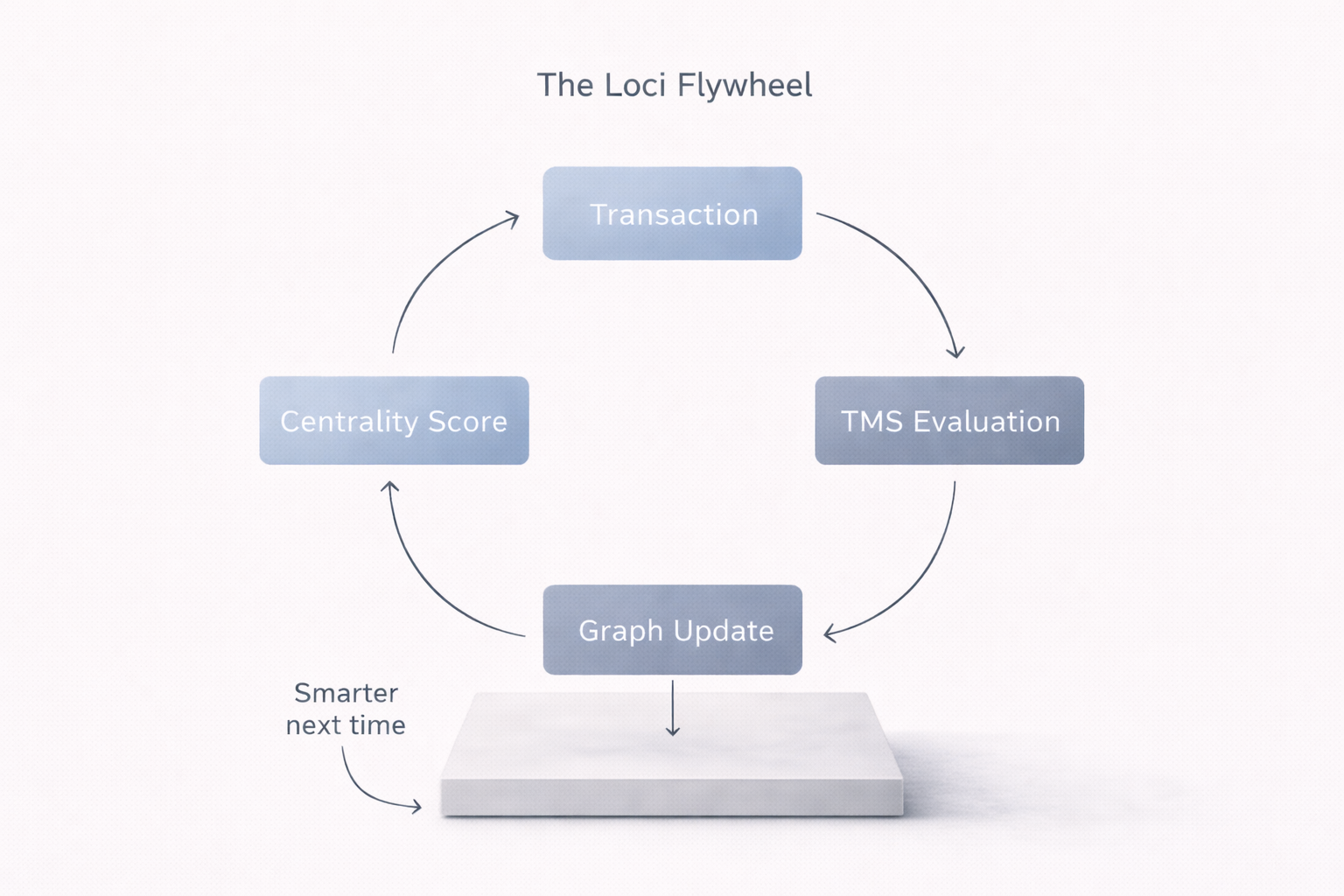

The Loci Flywheel

When used together, Loci's products create a self-reinforcing intelligence loop:

How it works:

- Call centrality first — Get the entity's network position before evaluating

- Submit transaction — MADIE evaluates with network context

- Graph updates — Transaction stored, entity relationships learned

- Better next score — Next centrality call has more data

This flywheel means your fraud detection improves automatically with every transaction—no retraining, no manual tuning.

Product Comparison

| Capability | Transaction Monitoring | AccessGate | AccessGate AML |

|---|---|---|---|

| Primary use | Payment fraud | Account takeover | Compliance |

| Decision speed | <200ms | <500ms | <100ms |

| Integration | REST API | SDK + API | REST API |

| Data required | Transaction data | Behavioral events | Name/identifiers |

| Learning | Adaptive calibration | Behavioral baselines | Static lists |

Choosing the Right Product

"I need to detect fraudulent transactions" → Start with Transaction Monitoring

"I need to prevent account takeover" → Start with AccessGate

"I need sanctions screening and KYC" → Start with AccessGate AML

"I need comprehensive protection" → Use all three. They share intelligence automatically.